Fill a Valid Iowa Resale Certificate Template

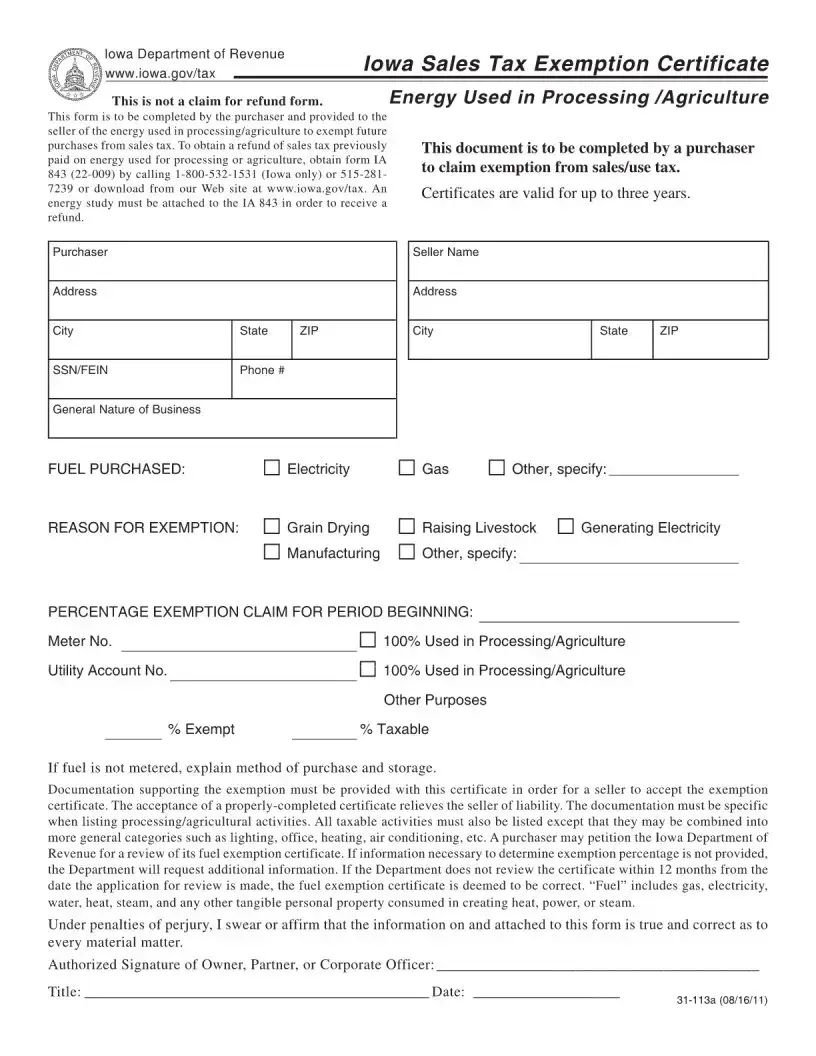

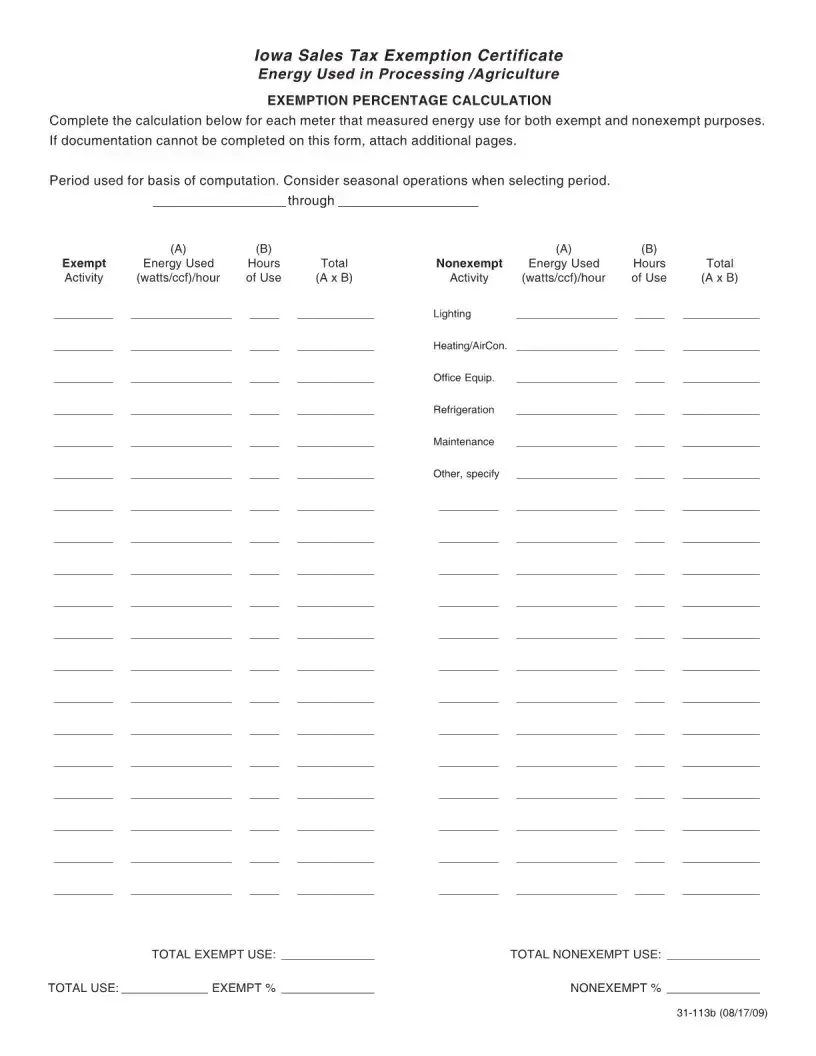

The Iowa Resale Certificate form serves as a vital tool for purchasers engaged in processing and agricultural activities, allowing them to claim exemption from sales tax on energy purchases. This form is specifically designed for buyers who use energy in their operations, such as electricity, gas, and other fuels, and it must be completed by the purchaser before being provided to the seller. By doing so, the seller is relieved of any tax liability associated with the sale. It is important to note that this certificate is valid for up to three years, making it essential for businesses to keep their documentation current. When filling out the form, purchasers must detail their business nature and specify the energy types they are claiming exemptions for, along with the reasons for exemption, which may include grain drying, manufacturing, or livestock raising. To substantiate their claims, purchasers are required to provide supporting documentation, ensuring that the exemption is valid and accurately reflects their usage. Additionally, if a purchaser seeks to obtain a refund for sales tax previously paid, a different form, the IA 843, must be utilized, and an energy study is necessary for processing the refund. The Iowa Department of Revenue plays a key role in reviewing these exemption claims, and if the required information is not submitted, they may request further details to determine the validity of the exemption. Overall, the Iowa Resale Certificate form is a crucial document that facilitates tax exemption for energy used in specific business activities, promoting economic efficiency for those in the processing and agricultural sectors.

Iowa Resale Certificate Preview

Document Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Iowa Resale Certificate is used to claim exemption from sales tax for energy utilized in processing or agriculture. |

| Form Type | This document is specifically referred to as the Iowa Sales Tax Exemption Certificate for Energy Used in Processing/Agriculture. |

| Validity Period | Certificates are valid for a maximum of three years from the date of issuance. |

| Documentation Requirement | Supporting documentation must accompany the certificate for the seller to accept the exemption. |

| Refund Process | To obtain a refund of previously paid sales tax, purchasers must use form IA 843 and include an energy study. |

| Exemption Review | Purchasers may petition the Iowa Department of Revenue for a review of their exemption certificate. |

| Seller's Liability | Acceptance of a properly completed certificate relieves the seller of any liability regarding sales tax. |

| Taxable Activities | All taxable activities must be listed, although they may be categorized broadly, such as lighting or heating. |

| Governing Law | The Iowa Resale Certificate is governed by the Iowa Code, specifically the provisions related to sales tax exemptions. |

Popular PDF Forms

Iowa 1040c - Tax is calculated following a detailed schedule provided, ensuring appropriate amounts are paid or refunded.

To ensure comprehensive protection, it is crucial to utilize a Hold Harmless Agreement, such as the one available through Texas Documents, which provides a clear framework for liability issues that may arise during your event or activity.

Iowa Poa - The IA 2848 form enables the appointment of an attorney, CPA, or other professional to handle tax matters on your behalf.