Fill a Valid Iowa Renters Rebate Template

The Iowa Renters Rebate form is a crucial tool for eligible residents seeking financial relief from their rental expenses. This form allows individuals, particularly seniors and those with disabilities, to claim a rebate based on their rental payments. To complete the form accurately, applicants must provide personal information, including names, birth dates, and Social Security numbers. It's essential to include proof of income and rental payments, as incomplete claims can lead to processing delays. Eligibility criteria are clearly outlined; for instance, applicants must have lived in Iowa during the specified year and meet certain income thresholds. Additionally, the form requires details about rental addresses and the duration of residency. Understanding the calculations involved is vital, as it determines the potential rebate amount. The process may seem daunting, but with careful attention to detail and the necessary documentation, eligible renters can benefit significantly from this program.

Iowa Renters Rebate Preview

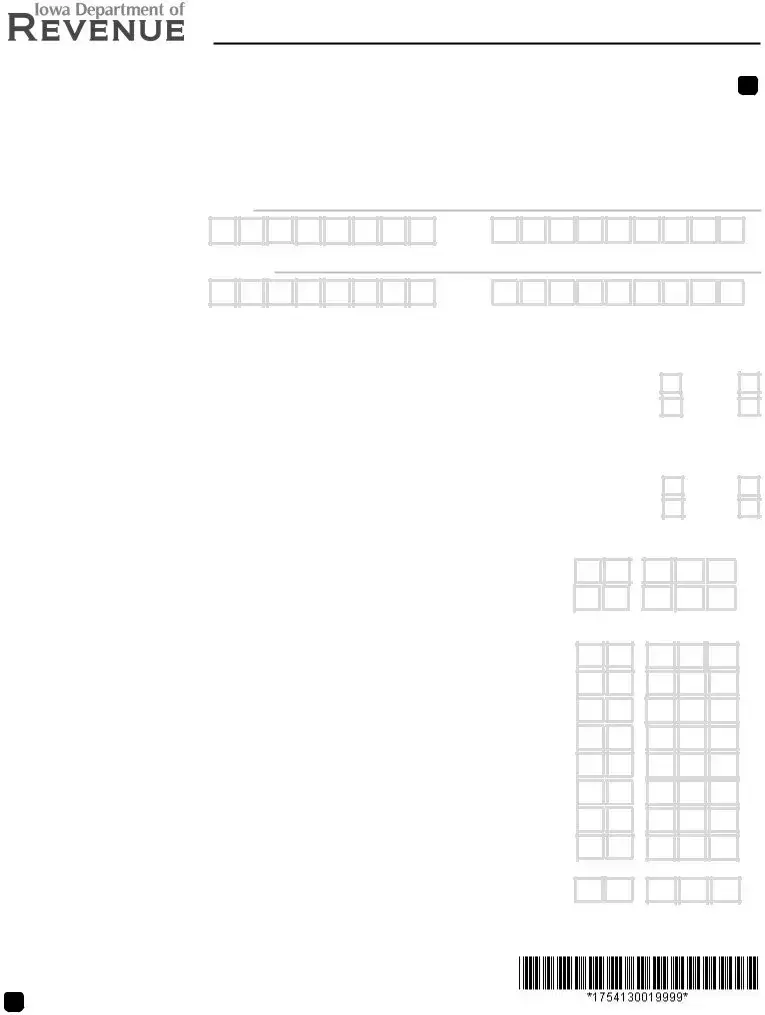

2021 IOWA RENT REIMBURSEMENT CLAIM

Page 1

tax.iowa.gov

Name and address:

•Complete using blue or black ink only. Do not use pencil or gel pen.

•Incomplete claims will delay processing. You may be contacted for additional information.

•Married couples living together are considered one household and can file only one claim, combining both incomes. If you do not live together, you may file separate claims.

Print your last name, first name:

Birth date (MMDDYYYY):

Print spouse last name, first name:

SSN:

Birth date (MMDDYYYY):

SSN:

Current mailing address (Include unit number): ______________________________________________

City:________________________________________________ State:__________ ZIP:____________

Who is eligible: |

|

|

|

1. |

Were you (or your spouse) born before 1957? |

Yes |

No |

2. |

Were you (or your spouse) born between 1957 and 2003 and totally disabled? .... |

Yes |

No |

|

Include a copy of your letter that shows you are disabled from the Social |

|

|

Security Administration, Veterans Administration, your doctor, or Form

3. |

Did you live in Iowa during 2021? If “no,” STOP; YOU DO NOT QUALIFY |

Yes |

4. |

Do you currently live in Iowa? If “no,” STOP; YOU DO NOT QUALIFY |

Yes |

Total annual household benefits and income:

For you and your spouse even if not reported for Iowa individual income tax purposes. Send proof of income.

No No

5.HUD, Section 8, and any portion of rent or utilities paid for you.

6.Title 19 benefits for housing only................................................................................

If you lived in a nursing home or care facility, contact the administrator for amount to enter on line 6. Or, enter 20% of benefits if living in a nursing home or 40% if living in a care facility.

7.Gross Social Security income. Include SSI and Medicare premium withheld. ...........

8.Gross disability income. Include SSDI, VA, and Railroad. Provide proof of disability.....

9.Wages, salaries, unemployment compensation, etc....................................

10.All pension, IRA, and annuity income. Include military retirement pay

11.Interest and dividend income.......................................................................

12.Profit from business/farming/capital gain.....................................................

13.Cash or checks received from others living with you. ..................................

14.Other benefits and income............................................................................................

Include child support, alimony, FIP, children’s SSI, welfare payments, gambling, etc.

15. Total annual household benefits and income. Add lines 5 through 14.........

Is line 15 $24,354 or more?

If yes, STOP; YOU DO NOT QUALIFY.

,

,

,

,

,

,

,

,

,

,

,

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Continue on next page |

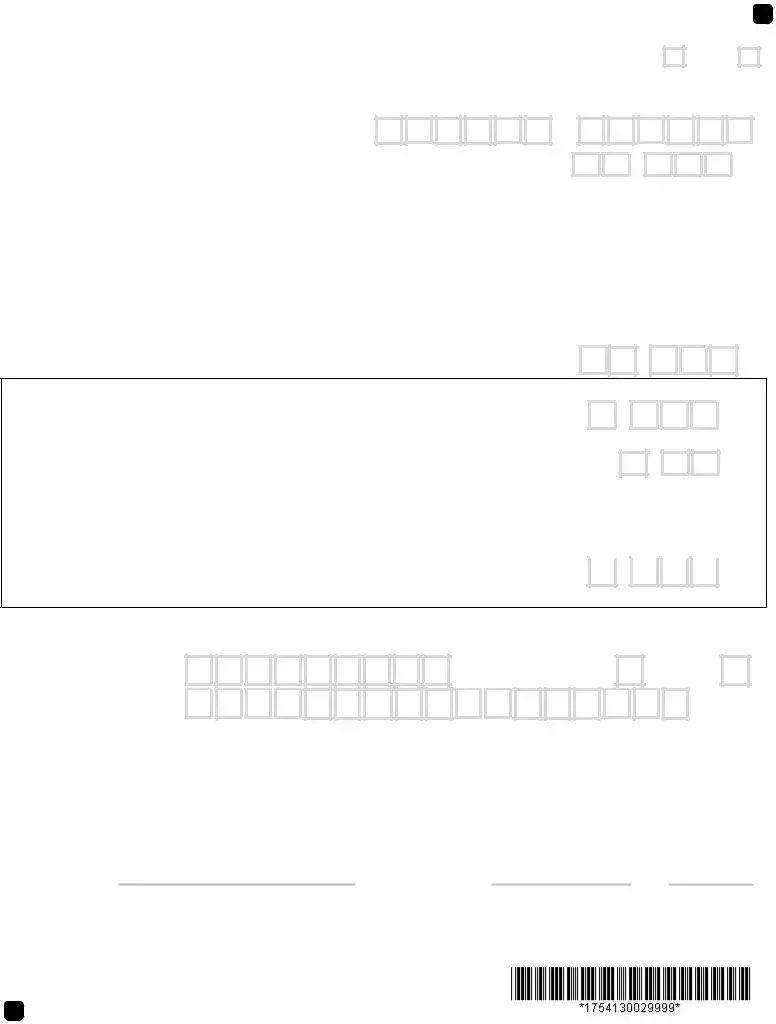

2021 IOWA RENT REIMBURSEMENT CLAIM, Page 2

Rental information: Complete the Statement of Rent Paid if you lived in more than one place.

16. Did you live in a nursing home or care facility? If yes, report Title 19 benefits on line 6. Yes

No

17.Rental address. The location where you lived must be subject to property tax. You are not eligible for rent reimbursement if the location or nursing home was not subject to property tax.

Dates you rented in 2021 (MMDDYY): from

to

Total Iowa rent you paid at this location...................................................

,

.00

Street (PO Box not allowed): ______________________________________________________

City: __________________________________________ |

State: |

ZIP: |

|||

Landlord or nursing home: |

|

|

|

|

|

Name:_________________________________________ |

Phone number: ( |

) |

|||

|

|

|

|

|

|

Address: ______________________________________________________________________

City: __________________________________________ State:_________ ZIP: ___________

If you lived in more than one location, complete the Statement of Rent paid for all other locations.

18. Total Iowa rent you paid in 2021. Add rent for all locations...........................

,

.00

This section optional: Complete lines 19 to 21 below, or allow the Department to compute for you.

19. Rent eligible for reimbursement. Multiply line 18 by 0.23, enter result. ......

,

.00

If more than 1,000, enter 1,000. Example: if line 18 = 3,900, multiply 3,900 x 0.23 = Enter 897 on line 19

20. Select rate from table below based on total benefits and income on line 15: |

X |

.

$0.00 - |

$12,545.99 |

enter 1.00 |

$18,450 - |

$21,401.99 |

enter 0.35 |

|||||||

$12,546 - $14,021.99 |

enter 0.85 |

$21,402 - |

$24,353.99 |

enter 0.25 |

||||||||

$14,022 - |

$15,497.99 |

enter 0.70 |

$24,354 or greater....STOP; you do not qualify. |

|||||||||

$15,498- |

$18,449.99 |

enter 0.50 |

|

|

|

|

|

|

|

|

|

|

21.Estimated reimbursement. Multiply line 19 by line 20. ...................................

Example: line 19 = 897, multiply 897 by 0.70 = 628, enter on line 21.

,

.00

Direct deposit information:

To receive direct deposit of your reimbursement to your account, complete lines A and B.

A.Routing number:

B.Account number:

Type: Checking

Savings

I, the undersigned, declare under penalties of perjury or false certificate, that I have examined this claim, and, to the best of my knowledge and belief, it is true, correct, and complete.

|

|

|

|

|

|

|

|

|

|

If deceased, |

|

Your signature: |

|

|

|

|

|

Date: |

|

|

|

date of death: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If deceased, |

|

Spouse signature: |

|

|

|

|

Date: |

|

|

|

date of death: |

||

Your phone number: ( |

) |

Preparer phone number: ( |

) |

|

|||||||

|

|||||||||||

Preparer name: |

|

|

Preparer signature: |

|

Date: |

||||||

►Include proof of income and rent paid. If under 65, also include proof of disability.

Mail to: Rent Reimbursement, Iowa Department of Revenue, PO Box 10459, Des Moines, IA

Document Attributes

| Fact Name | Description |

|---|---|

| Eligibility Criteria | To qualify for the Iowa Renters Rebate, applicants must be born before 1956 or be totally disabled and born between 1956 and 2002. |

| Income Limit | The total annual household income must be less than $24,206 to qualify for the rebate. |

| Rental Information | Applicants must provide details of their rental address and the total Iowa rent paid in 2020. The property must be subject to property tax. |

| Filing Together | Married couples living together must file one claim, combining both incomes. Separate claims are allowed if spouses do not live together. |

| Submission Details | Claims must be submitted with proof of income and rent paid. Mail completed forms to the Iowa Department of Revenue. |

Popular PDF Forms

Example of W4 Form Filled Out - Determining the start date and potential health coverage eligibility for new employees is facilitated by the Iowa 44-019A.

Iowa 1040c - Entities filing the IA 1040C form play a vital role in ensuring that nonresident income is appropriately taxed in Iowa.

For those in Texas looking to safeguard their interests, it's important to utilize the Hold Harmless Agreement effectively, and you can find the necessary template through Texas Documents, ensuring that your rights are protected as you navigate potential liabilities.

Iowa W 4P - Completing the Iowa W-4P correctly is crucial for retirees wanting to optimize their tax situation and avoid compliance issues.