Fill a Valid Iowa Ia 2848 Template

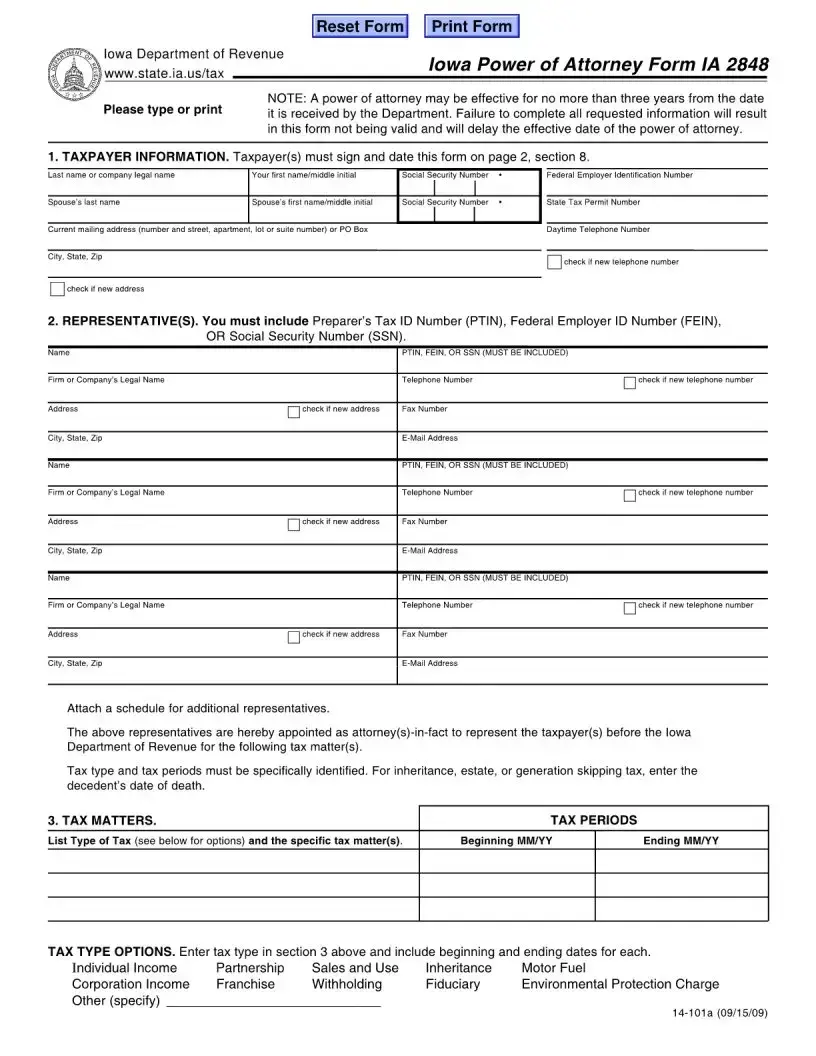

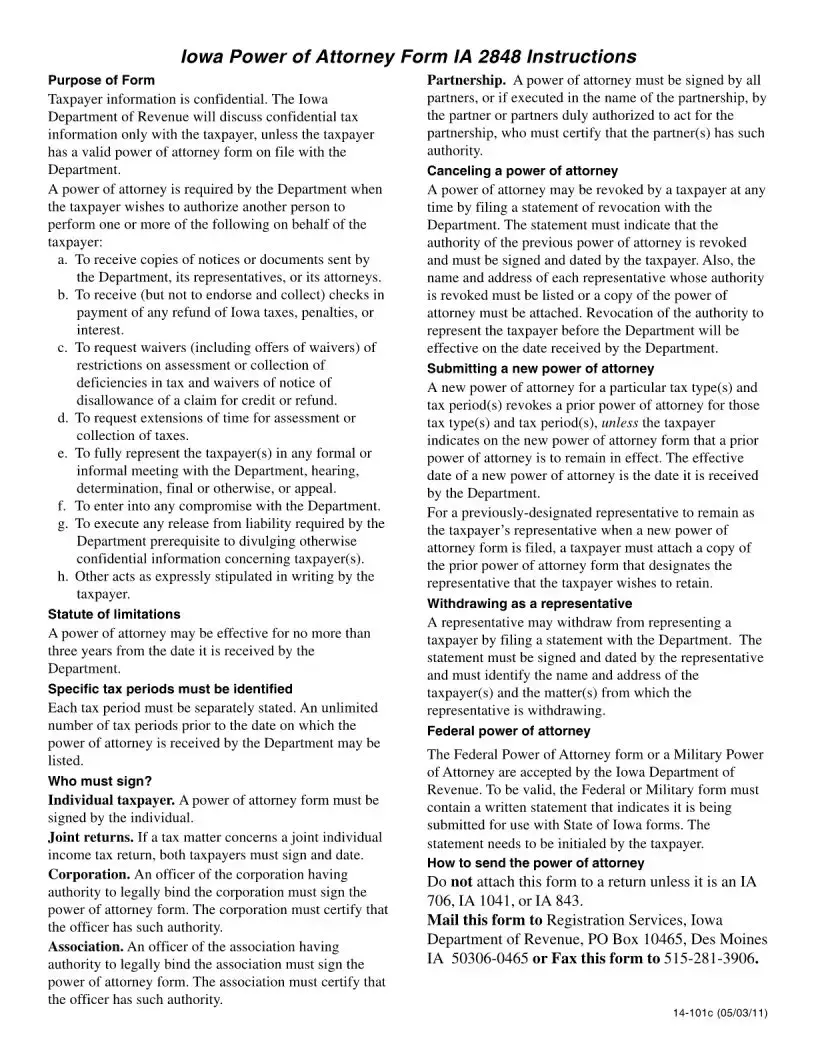

The Iowa IA 2848 form is an essential document for individuals and businesses seeking to authorize a representative to act on their behalf regarding tax matters with the Iowa Department of Revenue. This form is particularly important as it allows taxpayers to appoint attorneys-in-fact who can receive and inspect confidential tax information, negotiate agreements, and represent them in both informal and formal proceedings. However, it is crucial to note that the power of attorney granted through this form is effective for a maximum of three years from the date it is received by the Department. To ensure validity, all requested information must be completed accurately, including taxpayer details, representative information, and specific tax matters. Taxpayers must also sign and date the form, as failure to do so will render it invalid. The IA 2848 form covers various tax types, including individual income, sales and use, and corporate income, among others. Additionally, it allows taxpayers to specify if they wish to authorize their representative to receive refund checks. Understanding the components of this form can help streamline the process of managing tax-related issues and ensure compliance with Iowa tax regulations.

Iowa Ia 2848 Preview

Document Attributes

| Fact Name | Details |

|---|---|

| Form Purpose | The Iowa IA 2848 form is a Power of Attorney that allows a designated representative to act on behalf of a taxpayer in tax matters. |

| Validity Period | This form is effective for a maximum of three years from the date it is received by the Iowa Department of Revenue. |

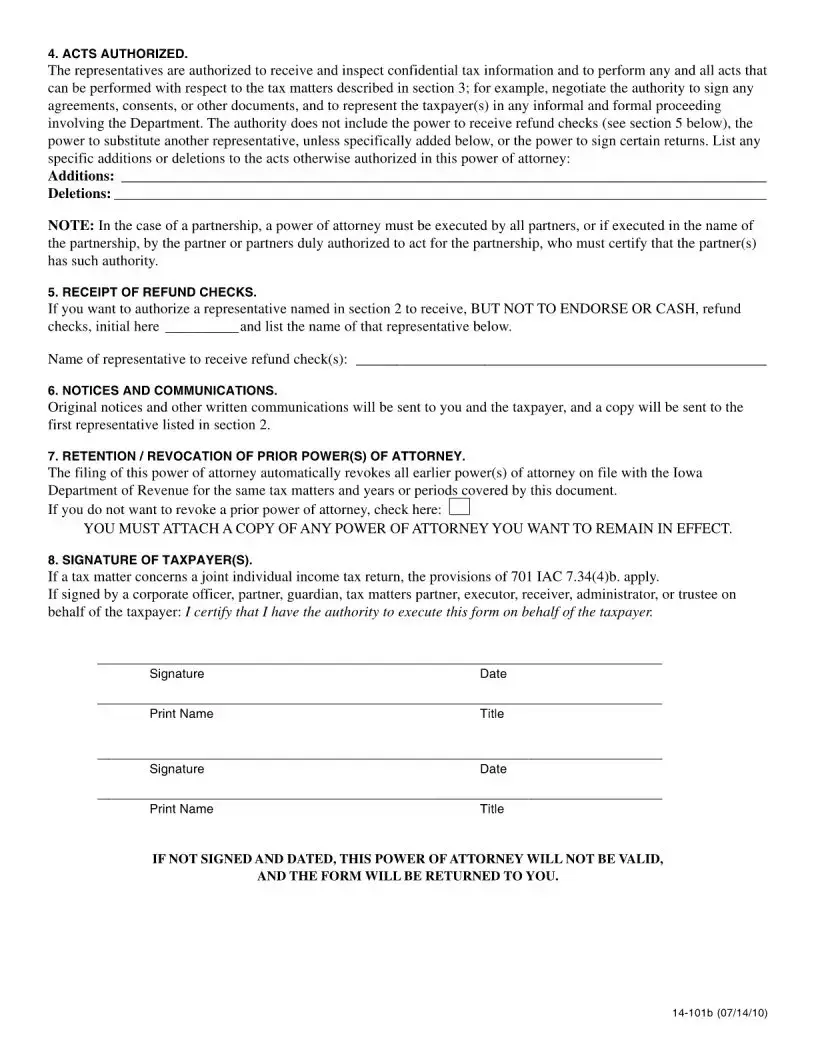

| Taxpayer Signature Requirement | Taxpayers must sign and date the form on page 2, section 8, for it to be valid. |

| Representative Information | Each representative must provide their Preparer’s Tax ID Number (PTIN), Federal Employer ID Number (FEIN), or Social Security Number (SSN). |

| Tax Matters Specification | Taxpayers must list the specific tax types and periods for which the representative is authorized to act. |

| Authorized Acts | Representatives can receive and inspect confidential tax information and negotiate on behalf of the taxpayer, but cannot receive refund checks unless specified. |

| Revocation of Prior Powers | Filing this form automatically revokes any previous Power of Attorney for the same tax matters and periods. |

| Notices and Communications | Original notices will be sent to the taxpayer and a copy to the first representative listed in the form. |

| Governing Law | The Iowa IA 2848 form is governed by the Iowa Administrative Code, specifically 701 IAC 7.34. |

Popular PDF Forms

How to Win a Termination of Parental Rights Case Iowa - Questions about past employment and readiness for future work opportunities help to build a foundation for vocational planning and support.

When preparing to enter into a Hold Harmless Agreement, it is crucial to recognize the significance of this legal document in protecting against liability, and resources are available to guide you through the process. For further assistance, you can explore the options provided by Texas Documents, which offers a variety of templates and support for creating a comprehensive agreement.

Iowa Next of Kin Law - It carefully outlines the responsibilities for final disposition, making the authorizing party aware of their obligations post-cremation.

Iowa State Patrol Reports - The categorization of the accident by codes helps in quick data analysis and policy making to improve road safety.